The ICICI Home loan calculator helps you find out how much you can borrow and what your EMI will be. This calculator allows you to enter several factors, including interest rate, prepayments, and fees. Once you have input all of these factors, you’ll have an accurate idea of the amount you can borrow.

ICICI Home loan eligibility

The eligibility criteria for ICICI home loan varies depending on your age and income. Lenders determine eligibility by looking at how much money you earn on a monthly basis and comparing that to your monthly obligations. This ratio helps them decide the maximum loan amount you qualify for. For example, if you earn Rs 25,000 a month, you would qualify for a loan amount between Rs 28,36,738 and Rs 50,36,589, depending on the interest rate you choose. Similarly, a salary of Rs 75,000 would qualify you for a loan amount between Rs 56,73,475 and Rs 1,00,73,178, depending on the type of loan that you apply for.

You will need to provide proof of your income and residence in order to qualify for an ICICI home loan. These documents can include your Aadhaar number, PAN, driving license, voter ID, and passport. Your bank account must also show salary credits for the last six months. If you are self-employed, you will also need to provide proof of your business’s existence. You can also negotiate loan eligibility and rates with an ICICI representative online.

ICICI home loan interest rate

ICICI Bank has cut the interest rate on home loans to 6.70%, effective from March 5, 2021. The revised rate is applicable for home loans worth up to Rs 75 lakh and above. The revised rate will be available till March 31, 2021. There is no need to take any action to continue making repayments on the home loan.

ICICI Bank has a wide range of mortgage products for all types of borrowers. You can avail a home loan with fixed or floating interest rates, depending on your requirements and credit score. In addition, home loans from ICICI Bank are tax-deductible under sections 80C, 80EE, and 24(b) of the Income Tax Act, 1961. You can also save a lot of money on interest by making part prepayments on your home loan.

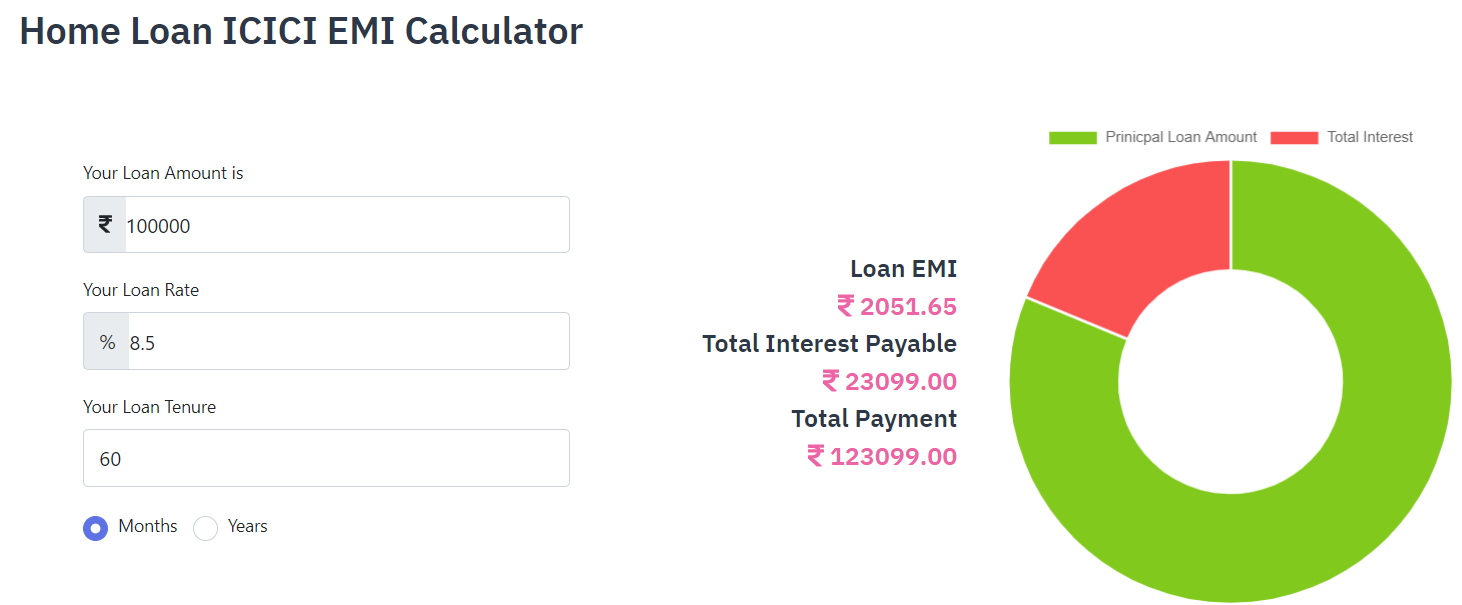

The ICICI home loan EMI calculator can help you calculate your monthly repayments. This tool is easy to use and provides accurate results. All you need to do is enter the loan amount, interest rate, and tenure. The calculator will then automatically calculate your EMI amount and deliver it on the same page. It takes less than a minute to use.

ICICI home loan EMI calculator

The ICICI Bank home loan EMI calculator is an easy-to-use tool that provides 100% accurate results. Just enter the amount you want to borrow, interest rate, processing fee and tenure to determine your repayment schedule. The calculator will show you your repayment schedule and the cheapest loan EMI at 8.60% p.a.

To use the ICICI home loan EMI calculator, go to the bank’s website and click on Tools and Calculators. Enter the loan amount, interest rate, and the loan tenure in years. The calculator will calculate the EMI amount and give you the result on the same page. The entire process takes less than a minute to complete.

The EMI calculator will calculate the EMI amount for any given loan amount, based on the lender’s criteria. The higher the loan amount, the higher the EMI. You can get an EMI calculator for any ICICI home loan by visiting the bank’s website.

ICICI home loan tenure

The ICICI home loan tenure calculator is a great way to figure out how much you will have to pay on your loan throughout the years. It is simple to use and will give you a real-time result. Using the calculator will help you make better credit decisions and negotiate for a lower interest rate.

The loan tenure is the length of time it will take to pay off the loan. The longer the tenure, the lower the EMI will be. An ICICI home loan has a 15-year tenure. A 10 Lakh loan with this tenure will have an EMI of Rs 10,024. In comparison, a five-year loan with the same interest rate will have an EMI of Rs 30,992 after 12 years.

The ICICI home loan can be a fixed-rate or a floating-rate loan. With a floating rate loan, the interest rate is subject to change based on changes in the MCLR and PLR. A majority of ICICI home loans are floaters. If you want to make sure that you’re not paying too much in interest, a floating-rate loan is the way to go.